The world of cryptocurrency mining, particularly Bitcoin mining, is a volatile and often bewildering landscape. The backbone of this digital gold rush lies in ASIC miners – Application-Specific Integrated Circuits – powerful machines designed specifically to solve the complex algorithms that secure the blockchain and earn rewards in the form of cryptocurrency. But navigating the market for these specialized pieces of hardware can be treacherous. Overpriced ASIC miners are a persistent problem, leaving unsuspecting buyers with significantly reduced returns and a hole in their wallets. So, how can you, the savvy investor or aspiring miner, avoid this costly pitfall? Industry experts offer a range of crucial tips.

First and foremost, understand the specifications. Don’t be swayed by flashy marketing or promises of astronomical profits. Focus on the hard data: the hash rate (measured in TH/s or GH/s, indicating the machine’s computational power), power consumption (in watts), and the miner’s efficiency (measured in joules per terahash, J/TH). A more efficient miner will consume less electricity while producing more hash power, directly impacting your profitability. Ignore these metrics at your peril.

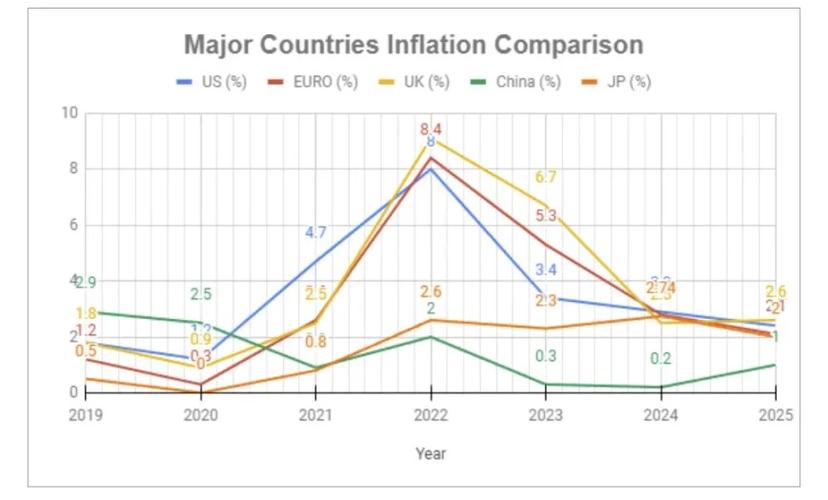

Next, benchmark against current market conditions. A miner’s price is intrinsically linked to the profitability of the cryptocurrency it mines, primarily Bitcoin. Websites like WhatToMine and Asic Miner Value offer real-time data on mining profitability, allowing you to estimate the daily, weekly, and monthly returns of various ASIC models. Factor in your electricity costs, pool fees (if you’re participating in a mining pool), and the current difficulty of the Bitcoin network (which affects how quickly you can solve blocks). Compare the price of the miner to its potential earnings over a reasonable timeframe, like 12-24 months. If the payback period stretches far beyond this, the miner is likely overpriced.

Another crucial aspect is the reputation of the seller. In the unregulated world of cryptocurrency mining hardware, scams and shady dealers abound. Stick to reputable vendors with a proven track record of delivering genuine equipment and providing reliable customer support. Read online reviews, check for forum discussions, and ask for references. Be wary of deals that seem too good to be true; they often are. Consider purchasing from established distributors, even if it means paying a slightly higher price, as the peace of mind and warranty protection are often worth the extra investment.

Don’t overlook the impact of Bitcoin’s halving events. Every four years, the reward for mining Bitcoin is cut in half. This drastically reduces the profitability of mining and can render older, less efficient miners obsolete almost overnight. Factor this into your long-term calculations. An older miner that seems like a bargain today may become a liability after the next halving. This consideration is especially important when evaluating used miners, which may be priced lower but carry the risk of rapidly declining profitability.

Beyond Bitcoin, consider the broader cryptocurrency landscape. While Bitcoin remains the dominant force in ASIC mining, some ASICs are designed to mine other cryptocurrencies, such as Litecoin (using the Scrypt algorithm) or Ethereum Classic (using the EtHash algorithm). The profitability of these altcoins fluctuates wildly, and the ASIC market for them is often less liquid and more susceptible to price manipulation. Exercise extra caution when considering miners for anything other than Bitcoin. Investing in machines for Dogecoin mining often involves different hardware considerations entirely, frequently relying on GPU-based rigs rather than specialized ASICs, leading to a different set of pricing factors to analyze.

Think about the operational costs beyond electricity. Cooling is a significant concern, especially in warmer climates. A miner generating a lot of heat will require efficient cooling solutions, adding to your expenses. Noise can also be a factor, particularly if you’re mining from home. Some miners are notoriously loud and may disrupt your neighbors (and your own sanity). Furthermore, consider the cost of maintenance and potential repairs. ASICs are complex pieces of technology, and breakdowns are inevitable. Having a reliable repair service or the technical expertise to troubleshoot issues yourself can save you significant downtime and lost revenue.

Finally, negotiate. The price of ASIC miners is often negotiable, especially when buying in bulk. Don’t be afraid to haggle and shop around for the best deal. Leverage the information you’ve gathered about market conditions, competitor pricing, and the seller’s reputation to your advantage. Remember, knowledge is power in the ASIC mining market, and a well-informed buyer is far less likely to fall prey to inflated prices. By diligently applying these tips, you can significantly reduce your risk of overpaying for an ASIC miner and increase your chances of success in the exciting, yet challenging, world of cryptocurrency mining. Research is key; don’t jump into the deep end without understanding the currents.

Leave a Reply to TrustBit Cancel reply