In the rapidly evolving realm of cryptocurrency, Bitcoin mining stands as a pillar of digital finance, underpinning the decentralized verification of transactions. As the market matures, investors and enthusiasts alike seek innovative ways to engage with mining operations without the heavy initial investment or technical complexity. Leasing Bitcoin mining machines emerges as a compelling solution, combining flexibility with a pathway to profit. Yet, the landscape extends beyond simple hardware acquisition—hosting services play an equally pivotal role, offering a seamless route to enter the mining industry while bypassing the logistical overhead of equipment management.

Leasing a Bitcoin mining machine essentially means renting sophisticated mining rigs equipped with specialized Application-Specific Integrated Circuits (ASICs) designed for optimal hashing power. Unlike purchasing, leasing reduces upfront capital expenditure, making the technology accessible for a broader demographic. This arrangement appeals particularly to those who are bullish on Bitcoin’s long-term value but prefer to mitigate the risks associated with hardware depreciation and fluctuating mining difficulty. Within this framework, miners benefit from steady hash rates, allowing them to forecast earnings with greater precision based on prevailing market conditions and mining difficulty adjustments.

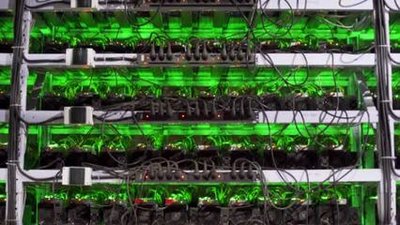

However, the acquisition of a mining rig is only part of the equation. The operational environment—power supply, cooling infrastructure, security, and maintenance—significantly influences profitability. Enter mining machine hosting services. By utilizing these services, lessees can situate their leased rigs in professionally managed mining farms, where operational expertise, scalable maintenance, and optimized energy utilization converge. This symbiosis elevates performance and minimizes downtime, which directly translates into higher returns on mining investments.

Hosting services are particularly advantageous in regions with inexpensive and stable electricity rates, a major operational cost determinant in mining profitability. The geographic selection of such facilities can significantly tilt the balance between marginal gains and losses. Hosting providers often establish operations in cooler climates where natural temperature regulation lowers cooling expenses, thus enhancing the overall efficiency of mining rigs. Furthermore, professional hosting services assure round-the-clock monitoring and rapid response teams, securing the hardware from technical failures and potential cyber threats—both of which could compromise mining outcomes and asset security.

On the technological frontier, the mining ecosystem is continuously adapting to the volatile interplay between Bitcoin and other prominent cryptocurrencies such as Ethereum (ETH) and Dogecoin (DOG). While Bitcoin mining leverages ASICs focusing on SHA-256 algorithms, Ethereum’s Proof of Stake transition and Dogecoin’s merged mining with Litecoin introduce alternative dynamics into mining strategies. For active participants, understanding how mining rigs can be deployed or leased to favor one currency’s difficulty patterns is imperative. Some leasing services even diversify hardware allocation, enabling miners to oscillate between currencies depending on profitability margins and market cycles.

Moreover, the ecosystem of cryptocurrency exchanges intertwines with mining operations in a subtle yet profound manner. Miners convert mined cryptocurrency into fiat or other digital assets through exchanges, often choosing between decentralized exchanges (DEXs) and centralized platforms. Timely and strategic asset conversion hinges on exchange liquidity and fee structures, impacting net profitability. For leasers and enthusiasts immersed in mining, monitoring exchange trends and pairing them with mining output optimizes the holistic financial model—transforming raw computational power into tangible economic returns.

The concept of mining farms extends beyond technological prowess, embodying the economies of scale necessary for consistent success. Large-scale mining farms amalgamate thousands of miners (even leased units), achieving remarkable hash rates that outcompete solitary operations. These farms become the nerve centers of blockchain networks, supporting transaction validation with remarkable efficiency. Participation in such collective mining enterprises through leasing and hosting arrangements democratizes access to these high-octane infrastructures. It enables smaller investors to partake in the cryptocurrency revolution without direct ownership of sprawling hardware arrays.

In closing, leasing Bitcoin mining machines complemented by professional hosting services represents an innovative confluence of opportunity and expertise. It mitigates traditional barriers such as capital intensity, technical complexity, and operational challenges, paving the way for scalable and efficient mining ventures. Whether the focus is Bitcoin, Ethereum, Dogecoin, or emerging altcoins, strategic leasing coupled with hosting maximizes ROI in an unpredictable and fast-moving digital frontier. This business model resonates deeply with those intent on transforming computational prowess into sustained crypto-assets, unlocking new vistas in the global decentralized economy.

Leave a Reply